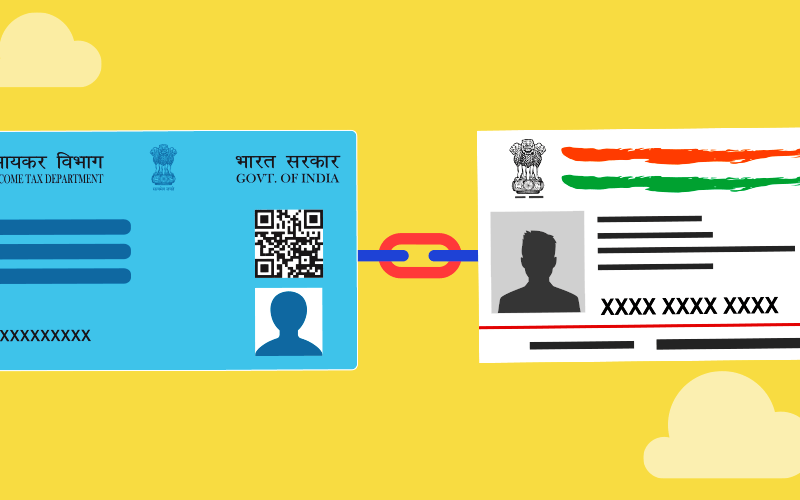

This order has been issued by the Income Tax Department of India that all PAN card holders will have to link their PAN card with Aadhaar card. At present, PAN cards are being made using Aadhaar card only, but if you had made your PAN card earlier and it is not linked to Aadhaar card, then it is important that you link your PAN card to Aadhaar card. If you do not know ‘How to link Aadhaar card with PAN card’ then read this article completely because in this article we are going to tell you the Pan Aadhaar Link 2024 Process.

Why is it important to link PAN card with Aadhar card?

When the government changed at the Center in the year 2014, one of the first things done by the Central Government was the launch of Aadhar Card. Before the arrival of Aadhar Card, there was no official document which could be used as an identity card, hence Aadhar Card was started and after that Aadhar Card was expanded in such a way that at present Aadhar Card is The card is useful everywhere. At present, Aadhar Card has become one of the most important documents for all the citizens of the country.

Using Aadhar Card, a strong infrastructure is being created in the country by the Central Government, for which the government is taking many different types of decisions which are necessary at present. Recently the Income Tax Department decided that everyone’s PAN card should be linked to their Aadhar card. At present, those who are making PAN card are getting their PAN card made through Aadhar card only, but those whose PAN card was already made, will now have to link it with Aadhar card due to the order of the Income Tax Department.

Benefits of linking Aadhar card with PAN card

- Earlier a person used to have more than one PAN card which was the cause of many problems but now the chances of a person getting more than one PAN card will reduce.

- After linking Aadhaar card with PAN card, tax evasion people will face problems but the Income Tax Department will find it easier to detect tax evasion.

- Once Aadhaar card is linked to PAN card, filing income tax returns will become much easier.

- If Aadhaar card is linked to PAN card, then the Income Tax Department will have better details about the taxes paid by the person.

Pan Aadhar Link 2024 – How to link Aadhar card with PAN card

If you have recently made your PAN card, then it is normal that you have made your PAN card using Aadhar card, in such a case your PAN card will already be linked to Aadhar card. But if you have already made a PAN card, then it is important that you link your PAN card with Aadhaar card because this is the order of the Income Tax Department. If you do not know how to link Aadhar card with PAN card, then the Pan Aadhar Link 2024 process you will have to follow is as follows:

- First of all, go to the official website of Income Tax Department http://incometax.gov.in/ from where you will be able to link your PAN card with your Aadhar card.

- After visiting this website, you will get an option of ‘Link Aadhar’ on the home page on which you will have to click.

- After this, in the page that will open in front of you, you will have to enter your PAN card number and your Aadhar card number and click on the option of ‘Validate’.

- After this your process will be completed and your Aadhar card will be linked to your PAN card, after which you will not face any problem related to it.

If you follow the process mentioned above exactly, then you will be able to link your PAN card with your Aadhar card very easily through the Income Tax website while sitting at home. Income Tax has ordered that people whose PAN card is not linked to Aadhar card should get their Aadhar card linked to their PAN card as soon as possible. In such a situation, you can link your Aadhar card with your PAN card by following the process mentioned above.